The Future of Money

By Stephanie Rowe & Eva Pascoe

The effects of Covid-19 have been felt far and wide across the globe, with widespread disruption ceasing a multitude of industries from shops to gyms and hotels. The international economy has undoubtedly been hit hard shrinking by 15-18% in the Western world. The Bank of England announced just last week, their efforts in quantitative easing, whereby £100 billion will be pumped into the UK economy in a bid to soften the blow of impending financial devastation. While there is much debate and anticipation as to the forecast for future money, one thing we can be certain of, is that the future of money certainly looks to be a turbulent one.

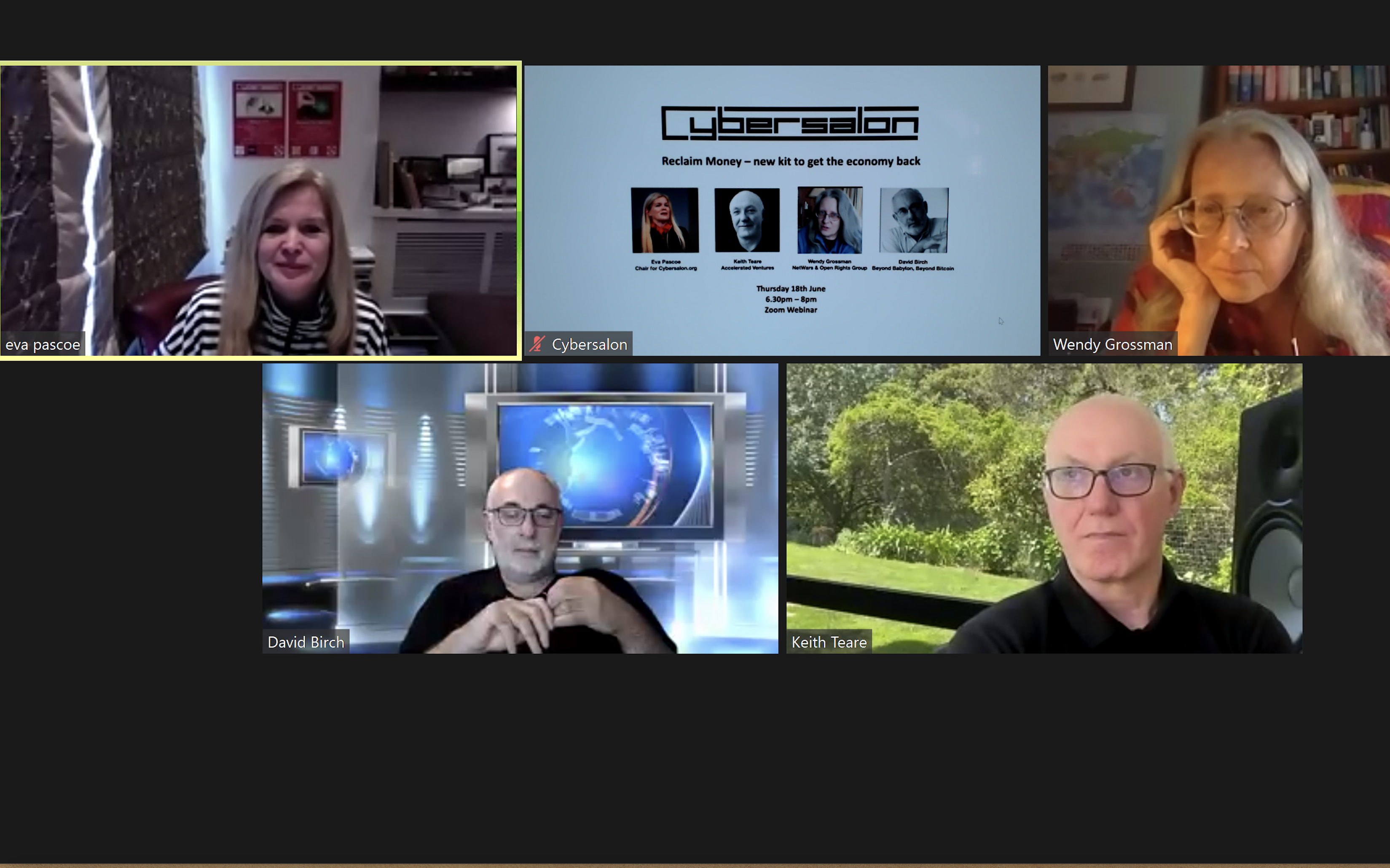

As a part of online June 2020 panels on Digital Futures, Cybersalon.org has invited David Birch, the author of new book, The Currency Cold War, to examine if digital currencies can help to bring our post-Covid economies to life.

Popping to the local

The idea of localised, city and community-based currencies is been long in coming. With sleek developments in the digital money space, this is a concept for contention in a post-Covid world as local digital currencies are now cheap to issue and cheap to run, as noted in Birch’s new book. Previously restricted to Central Banks, now money can (and is) issued by organisations like Facebook (Libra), cryptographers (bitcoin or ether), or States (Digital Dollar) and cities. The book explains the origins of money, as a tool for store of value and exchange but also a reflection of shared social values. As social consensus is creaking, so is the usefulness of centralised money.

Monies reflect the value of the communities they serve, and with London providing a substantial wedge of the UK’s economic weighting, a “London Coin” appears to drive a hard bargain. Eva Pascoe from Cybersalon.org, a veteran retailer and digital payment pioneer , noted that “the case for London Coin is gathering momentum, not least as London pays a lion share of UK taxes, funds every other UK city, yet gets almost nothing in exchange”, leaving disadvantaged people who live and work in the capital with very reduced support.

London’s economy is hugely different from economy of Midlands or North East, yet centralised money throws us all into the same interest rate zone. David Birth noted that “if centralised Euro is deemed too unfair to the Greeks, it follows that centralised dollar is unfair to economies of rural Ohio and centralised pound is unfair to post-industrial North East or tourism-led Cornwall”.

Could decentralisation of the UK economy provide prosperity in a modern and perhaps more reflective society? Of course, on the flip side of that very same coin, there is the argument of how that might pan out for the rest of the UK, who have undoubtedly, been operating in London’s shadow, happily taking London’s taxes yet refusing to accept London’s values.

What is in my pizza?

With the introduction of Bitcoin in 2009, the digitisation of money is far from a novel concept. In recent years digital money has become even smarter and slicker. Troy Norcross from Blockchain Rookies, another expert guest on Cybersalon.org panel, noted that “blockchain technology has bolstered more trust in cryptocurrencies and seems to be proving its worth as an un-hackable source for a myriad of uses, from real estate to data storage and financial transactions”.

Cryptocurrencies were arguably born out of a distrust for government handling, yet digitally stored values are still held at the mercy of people’s trust. You may not have thought of Akon since blasting out his hip-hop hits back in 2004, but while we have all been “locked up,” it seems the rapper is not quite so “lonely” anymore. In fact, he has been building his own city in Senegal, complete with a cryptocurrency to match. Akoin, coupled with developments in blockchain technology, he suggests, could be a “saviour” for Africa’s economy.

Tory Norcross makes a good point that ‘blockchain may not stop your chlorinated chicken making it to the dinner table, as wrong data can still be entered, but the transparency of supply chain makes insurance cheaper, a saving on food products that is being passed on to shoppers of Carrefour chain (France) or Walmart (USA).

Food on blockchain may be not necessary healthier, but it should be significantly more trackable and affordable, a welcome move from grocers as as every little helps in post Covid economy.

A whole new world of UBI

As the cost of issuing your own digital currency drops, some voices are calling for private businesses to fund Universal Basic Income. Keith Teare, Cybersalon.org guest dialing up all the way from Accelerated Digital Capital (Palo Alto), is offering a platform where retailers can issue global loyalty points, offering cash advance to everyone who will agree to shop with them in the future. Those who back the concept of Universal Basic Income are now looking to turn it into Universal Basic Coupon, something that Keith conceptualises as a new UBI dollar – Your Reward (YR) dollar, issued against global new identity.

At its core, UBI is a value that seeks to provide an unconditional income for each citizen. While progressive, this would take a whole rethink into not only our economic sector and political ventures, but a complete rethinking of what we deem to be “valuable” as a society.

However, re-think we must, as well as harness new digital platforms to support the vulnerable.

The extinction of cash?

And what of cash, the seemingly Dodo like creature of the economic world. We have all been strongly encouraged to use contactless payments for purchases made during lockdown through fear of its status as a virus-mongerer. It seems that while this suspicion of cash as a virus harbouring monster has not been all that accurate, many have dropped the cash sooner than you can say “corona”.

Reports suggest as much as a 60% reduction in cash withdrawals from cash machines. Our hole in the walls are plunging into a black hole of their own. But as Cybersalon.org guest and digital privacy campaigner Wendy Grossman (Open Rights Group) questioned, will this cashless society bring about a larger gap between the have and have nots? What about those with void of technology (and they do exist), with the risk of falling further into isolation as Digital Gap is increasing rapidly.

David Birch noted that those ‘unbanked’ are generally so by choice. His argument is that the lack of Digital Identity and too much cash economy created problems at the beginning of Covid crisis, where the governments simply did not have tech platforms to deliver support/furlough money digitally to those in need. That must be addressed if we want to be prepared for the Second Wave.

Our financial behaviour is certainly changing, with digital payments taking the hold. Perhaps there is more clarity to be gained in the coming months, as we see businesses emerge from this somewhat apocalyptic period and forge their new paths in the global economy. If one thing is clear from all the perpetual digital white noise, it is that the days of ever-increasing financial disparity are up.

It is time for a trustworthy, progressive and more encompassing digital money system to advance into the forefront of our economy? Might a post-Covid world finally see that playing out? The panel has demonstrated glimpses of this new world, with local currencies like London Coin and retailers (or indeed cities) picking up the support payments to their customers or citizens in need. Let’s not allow this traumatic crisis to go to waste but seek new, smarter and cheaper digital money to work for all of us.